Contents

- 1 Introduction

- 2 Understanding Family Budgeting

- 3 The Pillars of Financial Planning

- 4 Crafting Saving Strategies

- 5 The Essentials of Expense Tracking

- 6 Top Budgeting Tips for Every Household

- 7 Achieving Financial Freedom

- 8 Reducing Common Household Expenses

- 9 Understanding the 50/30/20 Rule

- 10 Setting and Achieving Financial Goals

- 11 Mastering Budget Planning

- 12 Advice for Unexpected Expenses and Financial Emergencies

- 13 Conclusion

- 14 FAQs

Introduction

In today’s world, being smart with your family’s money is more important than ever. It’s all about making good choices with your cash, from handling the costs of running a household to planning for your family’s future to reaching financial freedom. Family budgeting is at the heart of this. It’s not just about watching your income and expenses; it’s about making decisions that move your family closer to your financial goals.

This guide is like a lighthouse in the confusing world of managing money, offering straightforward, valuable tips on budgeting and saving that any family can use. We’ll cover everything from tracking your spending to planning your family budget. The goal? I want to show you how to take charge of your money, reduce money worries, and head towards a future filled with wealth and security. That’s what you can achieve with intelligent family budgeting.

So, if you’re looking to get a handle on your spending, save for something special, or hit big-money goals in the future, you’re in the right spot. Let’s start this journey together, arming you with the know-how to master your family’s finances. The road to financial freedom starts with intelligent budgeting and begins right now.

Understanding Family Budgeting

Let’s get into the nitty-gritty of family budgeting and why it’s such a big deal for keeping your finances on track. Imagine you’re planning a road trip. You’ve got your map (or your smartphone), your destination, and a rough idea of the stops along the way. Family budgeting is like mapping out that road trip. Still, instead of scenic stops and gas stations, you’re plotting your income, expenses, and financial goals.

So, what exactly is family budgeting? Think of it as a game plan for your money. It’s all about knowing what cash is coming in, what’s going out, and making sure you’re spending only what you earn. Simple, right? But here’s the kicker: a well-structured budget does more than just keep your spending in check; it helps you make wise money moves.

Let’s break it down with an example. Imagine the Jones family. They bring in a certain amount each month from their jobs. They have bills to pay and groceries to buy, and they’d love to save up for a vacation. By setting up a budget, they list all their monthly income and expenses. They see they’re spending a lot on eating out. With this insight, they decide to cook at home more often, freeing up some cash to tuck away for that beach getaway. This is them making an informed financial decision, thanks to their budget.

In essence, family budgeting is your financial compass. It points you in the right direction, helping you avoid spending pitfalls and guiding you towards your financial stability. Whether saving for a rainy day, investing in your future, or just making sure you can cover all your bills without sweating, a solid budget is your best friend. It’s about making your money work for you, not the other way around.

And hey, getting started might seem daunting, but it’s really about taking that first step. Once you get the hang of tracking your income and expenses, making those informed financial decisions becomes second nature. You’ll wonder how you ever managed without it. So, let’s buckle up and dive into the world of budgeting together—it will be a game-changer for your family’s finances!

The Pillars of Financial Planning

Diving right into the heart of financial planning, let’s talk about its cornerstone: setting financial goals and crafting a plan to hit them. Imagine you’re the ship’s captain, your family’s future is the vast ocean ahead, and your financial goals are the ports you aim to dock at. Without these destinations in mind and a map to reach them, you’d just be floating aimlessly at sea. That’s where financial planning comes into play—your map, compass, and GPS all rolled into one.

Setting Financial Goals

First, setting financial goals is like plotting the points on your map. These can range from short-term objectives, like saving up for a new laptop, to long-term ambitions, such as securing a comfortable retirement. The key here is specificity. Instead of saying, “I want to save money,” think, “I want to save $5,000 for an emergency fund in two years.” This clarity transforms a vague wish into a tangible target.

Developing a Financial Plan

Now, onto developing that financial plan. This is your strategy, the steps you’ll take to move from Point A (where you are now) to Point B (your financial goal). It involves budgeting, saving, investing, and managing debt. A solid plan is both realistic and flexible. Why? Because life loves throwing curveballs, and what works today might not work tomorrow.

Tips for a Realistic and Flexible Plan

Assess Your Current Situation: Take a good, hard look at your finances. This means all debts, income, savings, and expenses. You can only map a route if you know your starting point.

Set SMART Goals That are Specific, Measurable, Achievable, Relevant, and Time-bound. This framework turns fuzzy wishes into achievable goals.

Plan for the Expected and Unexpected: Sure, plan for the holidays and vacation savings, but also stash away something for those “just in case” moments. An emergency fund is a must-have in every financial plan.

Regular Check-ins: Just like you’d adjust your sails with the changing winds, regularly review and adjust your financial plan. Maybe you got a raise (yay!) or encountered an unexpected expense (ouch). Your plan should evolve with your life.

Involve the Whole Crew: Get your family involved in the financial planning process. When everyone’s on board, sticking to the plan becomes a team effort.

Remember, the goal of financial planning isn’t to restrict your life but to empower it. By setting clear financial goals and mapping out a plan to achieve them, you’re taking control of your financial future. You’re not just dreaming of a brighter tomorrow; you’re actively building the path to get there. And remember, every big journey begins with a single step. So, let’s set those goals, draw up that plan, and start sailing towards your family’s financial dreams. Ready to set sail?

Crafting Saving Strategies

Set Aside a Portion of Income: Right off the bat, make saving a non-negotiable part of your budget. Think of it as paying your future self. Whether it’s 10%, 20%, or even more, decide on a percentage of your income to save each month and stick to it. Automate this process if you can so it happens without you having to lift a finger.

Cut Unnecessary Expenses: Take a magnifying glass to your spending and look for expenses you can trim. Do you need that cable package you never watch, or could those dining-out dollars be better spent? Sometimes, saving more is about spending more intelligent, not living on less.

High-Interest Savings Accounts: Not all savings accounts are created equal. Shop around for accounts that offer higher interest rates. This way, your money isn’t just sitting there; it’s growing.

Seasonal Savings Plan: Plan well in advance for significant expenses—like holidays or birthdays. Setting aside a little bit each month can prevent a financial hangover later.

Rewards and Cashback: Take advantage of rewards programs and cashback offers for things you’re already buying. It’s like getting paid to shop.

Now, let’s pivot to keeping an eagle eye on your spending with the essentials of expense tracking. Knowing where your money goes each month is half the battle in mastering your finances.

The Essentials of Expense Tracking

The beauty of expense tracking is that it shines a spotlight on your financial habits, both the good and the not-so-good. Here’s how to get started:

Use Tools and Apps: There are many budgeting tools and apps out there designed to make tracking your spending as easy as pie. Apps like Mint, YNAB (You Need A Budget), or PocketGuard automatically link to your bank accounts and categorize your spending.

Make It a Family Affair: Involve the whole family in budgeting. It’s a great way to teach kids about money and make financial decisions together. Plus, when everyone knows the goals, staying on track is easier.

Review Regularly: Set a regular time each week or month to review your expenses. This isn’t about guilt-tripping over a coffee you didn’t need but recognizing patterns and adjusting where necessary.

Set Spending Limits: For categories that tend to balloon (like groceries, eating out, or entertainment), set clear spending limits. Knowing you have a cap can make you think twice before splurging.

Celebrate Wins: When you stay under budget or reach a savings goal, celebrate! It doesn’t have to be big, but acknowledging your progress keeps you motivated.

Crafting effective saving strategies and keeping a vigilant eye on expenses can transform your financial landscape. It’s not just about pinching pennies; it’s about making informed choices and prioritizing your financial well-being. With these tactics in your arsenal, you’re well on your way to a healthier bank account and a less stressful life. So, are you ready to take charge and watch those savings soar?

Top Budgeting Tips for Every Household

Start with a Clear Budget: First, you need a clear, detailed budget. This means knowing exactly what your income, expenses, and where there might be wiggle room for savings. Use spreadsheets, apps, or good old pen and paper—whatever works to keep you on track.

Prioritize Your Spending: Not all expenses are created equal. Essentials like rent, utilities, and groceries come first. Then, consider what’s truly important to your family. Maybe it’s a family outing once a month or a small travel fund. Identify these priorities and make sure your budget reflects them.

Cut Back on Non-Essentials: Look hard at your spending and see where you can cut back. Subscription services you rarely use, frequent takeout meals, or impulse buys can often be reduced without significantly impacting your lifestyle.

Save Automatically: Automate your savings like a bill payment. This way, saving becomes a non-negotiable part of your monthly expenses. Over time, these savings add up, moving you closer to your financial goals.

Embrace Communication: Talk about money openly with your family. When everyone’s in the loop about the financial goals and the budget, it’s easier to work together to meet them. Regular family finance meetings can keep everyone accountable and motivated.

Regular Budget Reviews: Life changes, and so should your budget. Regularly review your budget to adjust for changes in income, unexpected expenses, or shifts in financial goals. This keeps your budget realistic and flexible.

Achieving Financial Freedom

Achieving financial freedom might seem like a lofty goal, but it’s entirely possible with discipline, smart budgeting, and a solid plan. Here’s how you can start moving towards a life where you’re in control of your finances, not the other way around.

Tackle Debt Head-On: High-interest debt, like credit card debt, can eat away at your finances. Prioritize paying this down by focusing on the highest interest rates first while still making minimum payments on other debts. Consider debt consolidation or speaking with a financial advisor for personalized advice.

Build an Emergency Fund: Aim to have three to six months’ worth of living expenses saved up. This fund acts as a buffer against unexpected expenses or job loss, reducing the need to take on more debt.

Invest in Your Future: Once you have your debt under control and your emergency fund in place, start thinking about long-term investments. Retirement accounts, stocks, or real estate can offer returns that outpace inflation, growing your wealth over time.

Live Below Your Means: Embrace a lifestyle that allows you to spend less than you earn. This doesn’t mean living without any luxuries but rather making mindful choices that align with your financial goals.

Inspiring Stories: Consider the story of the Rivera family, who paid off $30,000 in debt in two years by sticking to a strict budget, cutting unnecessary expenses, and taking on side jobs. Or the Johnsons, who achieved their dream of buying a home outright by living frugally and saving aggressively. These stories prove that attaining financial freedom is within reach with determination and intelligent financial strategies.

By applying these budgeting tips and focusing on the steps toward financial freedom, you’re building a strong foundation for your family’s financial future. It’s about making informed decisions, sticking to your plan, and adjusting as needed. Remember, the journey to financial freedom is a marathon, not a sprint, and every step you take brings you closer to your goals.

Reducing Common Household Expenses

- Needs vs. Wants: The first step is to categorize your spending into ‘needs’ (things you absolutely must have to live, like food and shelter) and ‘wants’ (things that are nice to have but not essential, like the latest gadgets or designer clothes). Once you’ve sorted that, prioritize your spending on the ‘needs’ and be more discerning about the ‘wants.’

- Groceries: Saving money on groceries doesn’t mean you have to compromise on quality. Here are a few tips:

- Plan Your Meals: Planning helps avoid impulse buys and reduces waste.

- Buy in Bulk: For non-perishable items, buying in bulk can save money in the long run.

- Go Generic: Store brands often offer the same quality as name brands for a fraction of the cost.

- Use Coupons and Cashback Apps: Take advantage of discounts and cashback offers where you can.

- Utilities: Reducing utility bills might be easier than you think. Consider:

- Energy-Efficient Appliances: They can be more expensive upfront but save money over time.

- Smart Thermostats: These adjust your home’s temperature automatically, saving on heating and cooling costs.

- Water-Saving Fixtures: Low-flow showerheads and toilets can significantly reduce water bills.

- Unplug Electronics: Even when they’re turned off, electronics can consume energy. Unplug them when they’re not in use.

- Entertainment: Fun doesn’t have to break the bank. Get creative with how you entertain your family.

- Free Community Events: Check out free events in your community, like concerts, workshops, and festivals.

- Library Perks: Libraries offer more than just books; you can often find movies, games, and free passes to local attractions.

- At-Home Movie Nights: Skip the expensive cinema trip. Stream a movie, pop some popcorn, and enjoy a cosy night in.

- Outdoor Adventures: Nature is free! Hiking, biking, or a day at the beach provides entertainment without the price tag.

- Prioritize Spending: With your expenses clearly categorized, allocate your budget based on priorities. Essentials come first, savings next, then debts, and finally, if there’s room, a little something for those ‘wants.’

By applying these strategies, you can manage your household expenses more effectively, freeing up funds for savings or paying off debt. Remember, the goal isn’t to live a life of deprivation but to make smart choices that align with your family’s financial goals. With a bit of creativity and discipline, you’ll find that managing your expenses isn’t just possible—it can even be enjoyable.

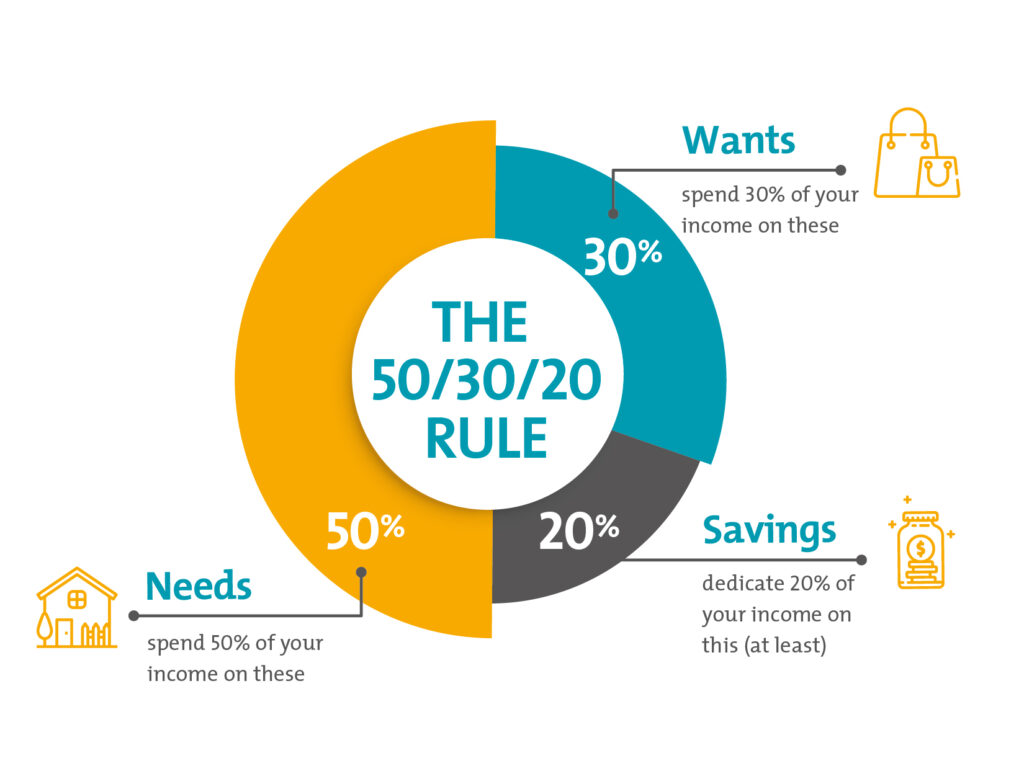

Understanding the 50/30/20 Rule

Here’s a quick breakdown:

50% Needs: This portion of your income should cover those absolute essentials in life—think rent or mortgage, groceries, utilities, and health insurance. These are your must-haves for getting by day to day.

30% Wants: This bit is for those things that bring you joy and comfort but aren’t strictly necessary for survival. Dining out, your Netflix subscription, that cute pair of shoes you’ve been eyeing? They all come out of this slice of the pie.

20% Savings: The final chunk goes towards your future. This could be paying off debt beyond minimum payments, building up your emergency fund, or contributing to retirement accounts. It’s all about preparing for what’s ahead, ensuring you’re not just living for today but planning for tomorrow as well.

Instilling Good Money Management in Children

When it comes to teaching kids about money, it’s never too early to start. Here’s why it’s so important and some tips on how to do it:

Why It Matters?

- Builds Responsibility: Understanding the value of money and how to manage it responsibly sets children up for a lifetime of financial savvy.

- Encourages Independence: By learning to budget, save, and spend wisely, kids grow into financially independent adults.

- Prepares for the Future: Early lessons in money management can help prevent financial mistakes down the road and instil confidence in making sound financial decisions.

How to Teach It? - Lead by Example: Kids learn a lot by observation. Let them see you budgeting, saving, and making thoughtful spending decisions.

- Give an Allowance: An allowance can be a powerful tool for teaching about budgeting, saving, and the consequences of financial choices.

- Open a Savings Account: Help them open a savings account to teach them about interest, future savings, and how banks work.

- Play Money Management Games: Plenty of games and apps are designed to teach financial literacy in a fun, engaging way.

- Discuss Wants vs. Needs: This is a fundamental concept that even young children can grasp. Use everyday decisions to highlight the difference between the two.

Adopting the 50/30/20 rule in your financial planning not only sets a solid example for your kids but also opens up opportunities to discuss and practice these principles together. Remember, good money management is a blend of discipline, knowledge, and habit formation—invaluable skills for you and your children. So, whether you’re fine-tuning your budget or teaching your little ones about dollars and cents, remember these principles for a financially healthier and more mindful future.

Setting and Achieving Financial Goals

Short-Term Financial Goals are your sprints. These are objectives you aim to achieve within a year or less. They’re crucial for managing your financial health and preparing for upcoming expenses. Examples include:

- Saving for a vacation

- Building an emergency fund with three months’ worth of expenses

- Paying off a small debt

Long-Term Financial Goals are your marathons, requiring endurance and persistence. These are the goals you expect to achieve in several years or decades and are often focused on significant life impacts. Examples include:

- Paying off your mortgage

- Saving for retirement

- Funding your child’s college education

Tools and Methods to Track Progress:

- Budgeting Apps: Many apps can help you set financial goals and monitor your progress, offering insights and reminders.

- Spreadsheets: For those who prefer a more hands-on approach, custom spreadsheets can track goals, expenses, and savings.

- Financial Planners: Sometimes, a professional can offer guidance to set realistic goals and strategies for achieving them.

Mastering Budget Planning

- Creating an adequate family budget is like drawing a map for your financial journey. It outlines where you are, where you want to go, and how you’ll get there. Here’s how to do it:

Assess Your Income and Expenses: Start clearly understanding your monthly income and what you spend it on. This includes fixed expenses (like rent) and variable expenses (like groceries).

Set Realistic Goals: Based on your assessment, set realistic and achievable financial goals. Incorporate both short-term and long-term objectives.

Allocate Your Resources: Use the 50/30/20 rule to guide how much to allocate towards needs, wants, and savings.

Track Spending: Keep an eye on where every dollar goes. This will help you identify areas where you can cut back and save more.

Adjust as Necessary: Life is full of surprises. Your budget should be flexible enough to accommodate unexpected expenses, such as car repairs or medical bills. This might mean revisiting and adjusting your budget regularly.

Emergency Fund: Part of adjusting for the unexpected includes building and maintaining an emergency fund. This fund acts as a financial buffer and should be a key component of your budget planning.

Review and Revise: Regularly review your budget and financial goals. As your financial situation changes, so too should your budget.

Advice for Unexpected Expenses and Financial Emergencies

- Prioritize Expenses: When faced with unexpected expenses, prioritize your spending based on immediate needs.

- Adjust Your Savings: Temporarily redirect some of your savings contributions towards covering unexpected expenses.

- Emergency Fund: Utilize your emergency fund for true emergencies, then focus on replenishing it as soon as possible.

By setting clear financial goals and mastering the art of budget planning, you’re not just surviving; you’re thriving. You’re preparing your family to weather economic storms and sail smoothly towards your dreams. Remember, the key to a successful budget is not just in its creation but in its execution and adaptability. So, embrace the journey, adjust, and celebrate each milestone.

Conclusion

Wrapping up our journey on handling family finances better, it’s clear that getting your money right involves knowing what to do and putting that knowledge into action. Every step is essential for building a secure future for you and your family, from setting up a family budget and keeping track of what you spend to smart saving, dealing with debt, and making your money grow.

We’ve discussed the 50/30/20 rule for money management, the big deal of setting financial goals, and shared tips for making a reasonable budget plan and cutting household expenses. These tips aren’t just about watching numbers; they’re about making intelligent choices that bring peace and freedom to your money matters.

Remember, reaching your money goals is a personal journey that needs time, effort, and the ability to change your plan when life throws surprises at you. Start with these steps, stick with them, and change them as needed. Your financial health is in your hands, and with the right approach and tools, you’re all set to build a bright and secure future for your family. Let’s do this!

FAQs

Q: How often should I review my family budget?

A: Ideally, review your budget monthly. This allows you to adjust for any changes in income or expenses and stay aligned with your financial goals.

Q: What if I can’t stick to my budget?

A: It’s normal for budgets to require adjustments. If you need to spend more money consistently, revisit your budget to ensure it’s realistic. Look for areas to cut back or consider ways to increase your income.

Q: How can I save money if I’m living paycheck to paycheck?

A: Review your expenses to identify non-essential items that can be reduced or eliminated. Even small savings can add up over time. Consider seeking additional sources of income, such as part-time work or selling unused items.

Q: Is it too late to start budgeting and saving for retirement in my 40s?

A: It’s always possible to start! While starting earlier can give you a head start, taking action now is better than not acting at all. Focus on maximizing your savings and exploring retirement account options with tax advantages.

Leave a Reply